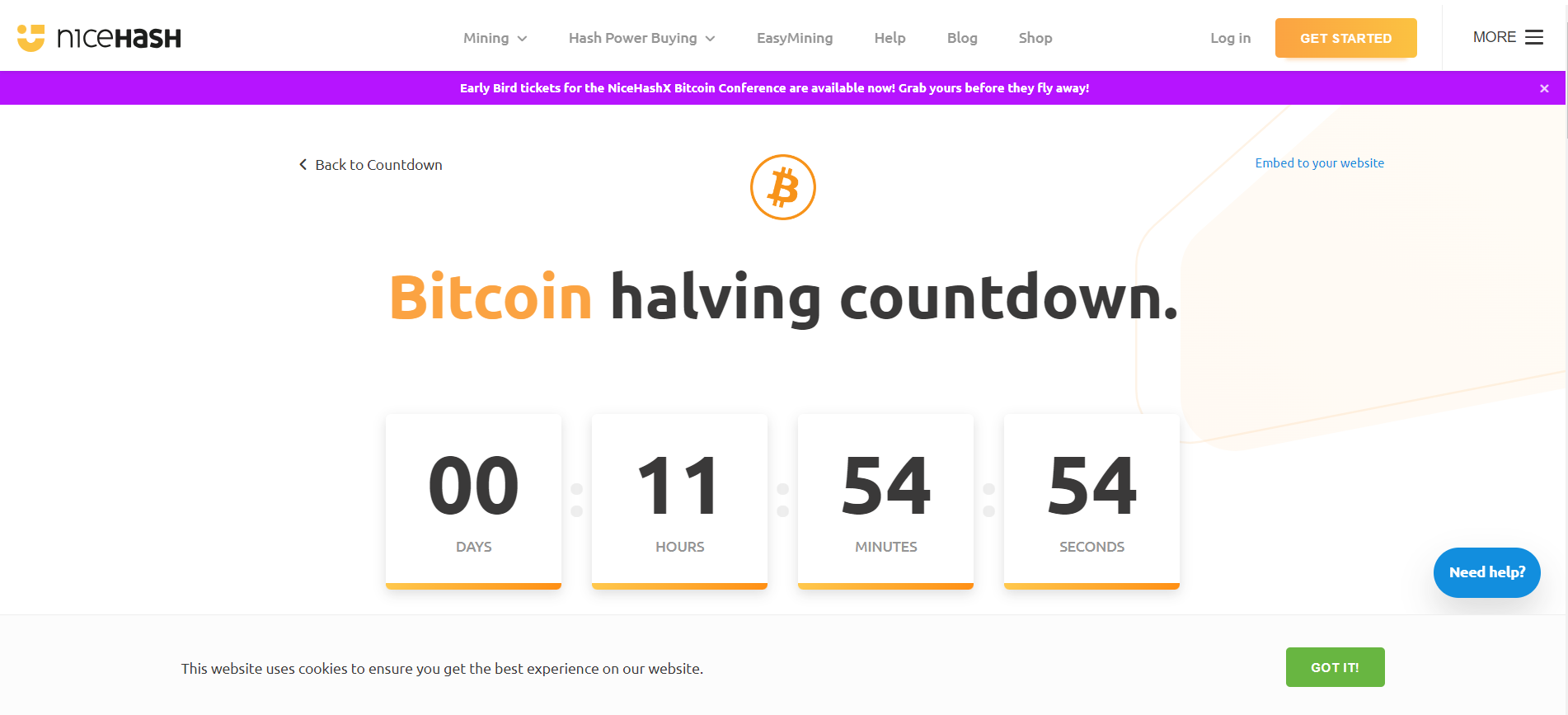

Let’s explore five amazing facts about Bitcoin’s upcoming fourth halving on April 19, which may surprise even seasoned cryptocurrency enthusiasts.

The Bitcoin community celebrates the Bitcoin halving every four years. Given its historically positive impact on the cryptocurrency market, many BTC market analysts view this as a significant event. As the fourth halving of Bitcoin approaches on April 19, let’s examine five fascinating facts about this phenomenon that might surprise even the most ardent cryptocurrency fans.

Since the original halving event, the price of Bitcoin has increased by over 650,000% ??

Historically, the price of Bitcoin has usually increased following a halving, mostly due to supply and demand dynamics.Analysing historical data reveals some intriguing trends: After the initial halving on November 28, 2012, the price of Bitcoin shot up from $11 to a record high of $1,240 in less than a year. In a similar vein, Bitcoin’s price surged from about $650 to a new peak of $20,000 by December 2017 following the second halving in July 2016.After the third halving in May 2020, the price of Bitcoin shot up from about $8,800 to almost $69,000 by November 2021. With the first halving, there has been an astounding 650,000% increase, as evidenced by this remarkable growth.After the halving, a number of factors have increased demand for Bitcoin. For example, in 2020–2021, the generally accommodating position of international central banks markedly increased.

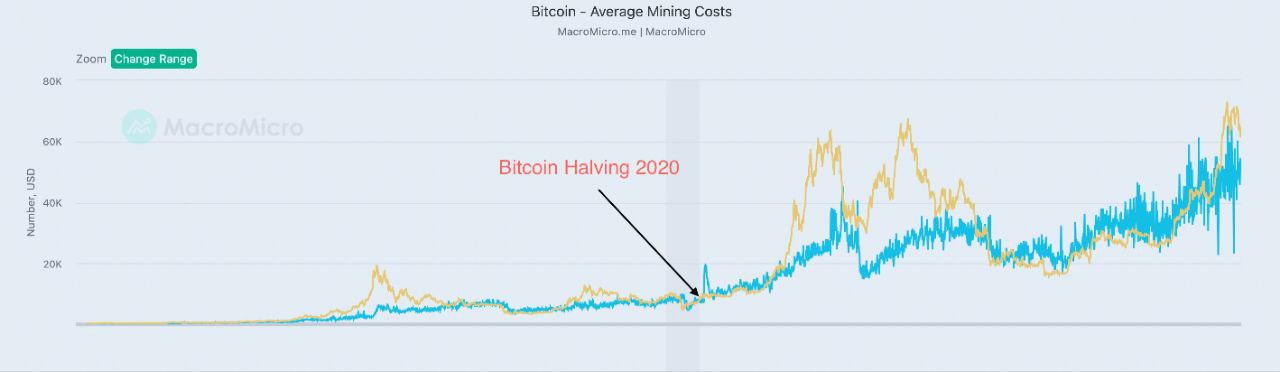

Halvings put the financial resilience of miners at risk.

Miners’ earnings from transaction verification are reduced by half with each reduction, making profitability issues more difficult, particularly for those with greater operating costs. Because of this situation, miners are forced to stop working or switch to more efficient technology.The average cost of mining one Bitcoin increased after the third halving in May 2020, as shown by the blue wave in the chart below.Smaller miners were forced out of the market by this increase in operating costs, which might have accelerated network centralization.

Prior to halving events, price spikes may be speculative.

Speculative price surges are frequently triggered by anticipation of a Bitcoin halving.For instance, the price of Bitcoin increased by more than 40% in the six months preceding the 2020 halving, from roughly $7,000 in November 2019 to about $10,000 by May 2020.Speculative investors usually drive these increases in order to profit from anticipated price hikes following a halving, which is consistent with past trends and adds to market volatility.Supply shocks are the foundation of a post-halving price surge theory. Bitcoin’s daily production fell with each of the first three halvings, from 50 to 25 to 12.5 and, most recently, to 6.25 BTC per block in 2020. If demand doesn’t decline, this reduction might cause big changes in prices.

The macroeconomic influence on Bitcoin halving cycles.

The broader economic landscape significantly influences how Bitcoin halvings affect its price.For instance, during the 2020 halving, there were loose monetary policies, including near-zero interest rates in the U.S. This environment enhanced Bitcoin’s allure as a “digital gold,” propelling its price from approximately $8,000 during the halving in May 2020 to an unprecedented high of nearly $69,000 by November 2021.

It is anticipated that the last Bitcoin halving will happen within the next century.

By around 2140, the last Bitcoin is expected to be mined as a result of the halving mechanism. After this last halving, miners won’t get block rewards in fresh Bitcoin and will only be able to make money from transaction fees.This shift has the potential to significantly change the security and economic structure of Bitcoin, affecting things like miner participation and transaction fees.